Strategies

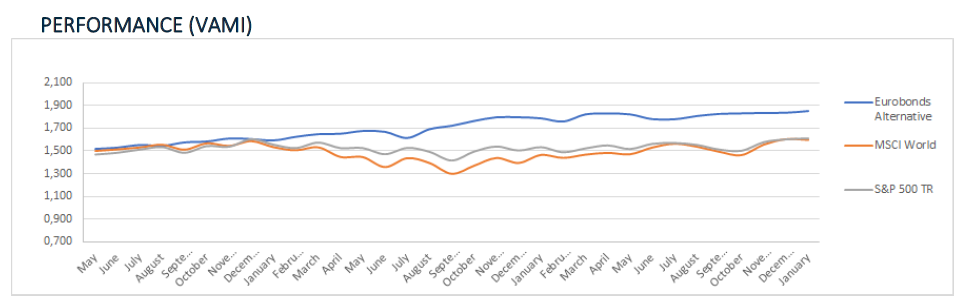

Eurobonds Alternative

Average Monthly Target: 1.5% – 2.5%

Minimum deposit: 30.000€

Drawdown: 20%

Regulation: MFSA (EU)

Broker: Interactive Brokers

Eurobonds Tactical

Average Monthly Target: 1.0% – 1.5%

Minimum deposit: 50.000€

Drawdown: 15%.

Regulation: MFSA (EU)

Broker: Interactive Brokers

Disclaimer:

There is substantial risk of loss in trading complex financial instruments, such as CFDs, futures, options and off-exchange foreign currency products. Past performance is not indicative of future results.

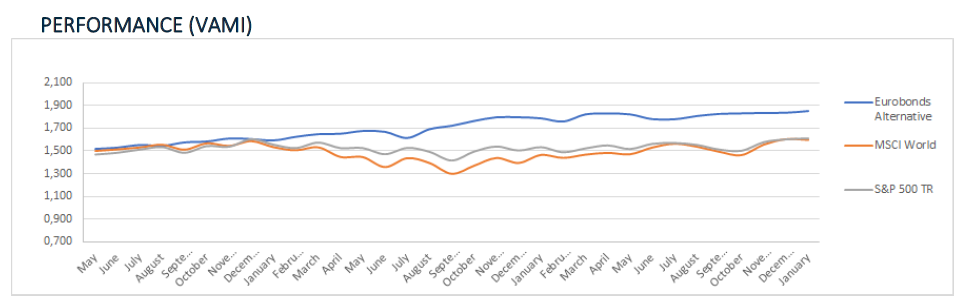

Eurobonds Alternative

Eurobonds Options is an alternative strategy with absolute return. The objective of the investing model is to achieve significant capital growth over the medium term with medium volatility by allocating part of the capital to listed Futures, and Options’ strategies (which are made up of proprietary revised studies on Iron Condor and Calendar Spreads, and volatility arbitrages).

Historical Data

Average Monthly Target: 1.5% – 2.5%

Minimum deposit: 30.000€

Drawdown: 20%

Regulation: MFSA (EU)

Broker: Interactive Brokers

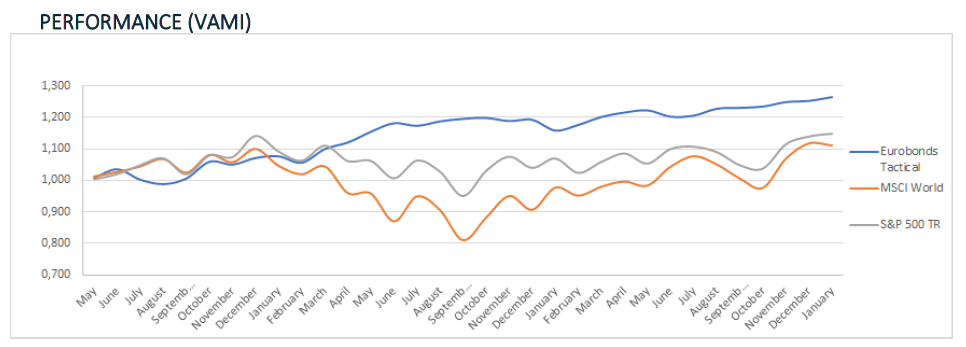

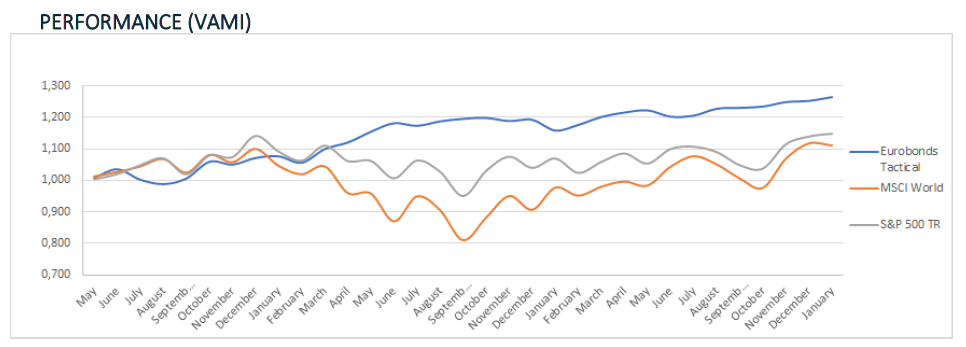

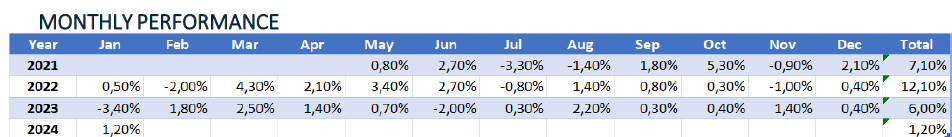

Eurobonds Tactical

Eurobonds Tactical is an absolute return strategy. The model, tactically, invests in different asset classes (Bonds, Equities, ETF, Futures, Options), where the derivative component is exploited: mostly for convexity purposes, namely, to create a portfolio component uncorrelated with the other asset classes in which the model invests: this allows a solid risk management optimization through a proprietary revised studies on Iron Condor, Calendar Spreads, and volatility arbitrages.

Historical Data

Average Monthly Target: 1.0% – 1.5%

Minimum deposit: 50.000€

Drawdown: 15%

Regulation: MFSA (EU)

Broker: Interactive Brokers

English

English

Italiano

Italiano  Español

Español